Why Smart People Get Scammed: 7 Psychological Triggers Exposed

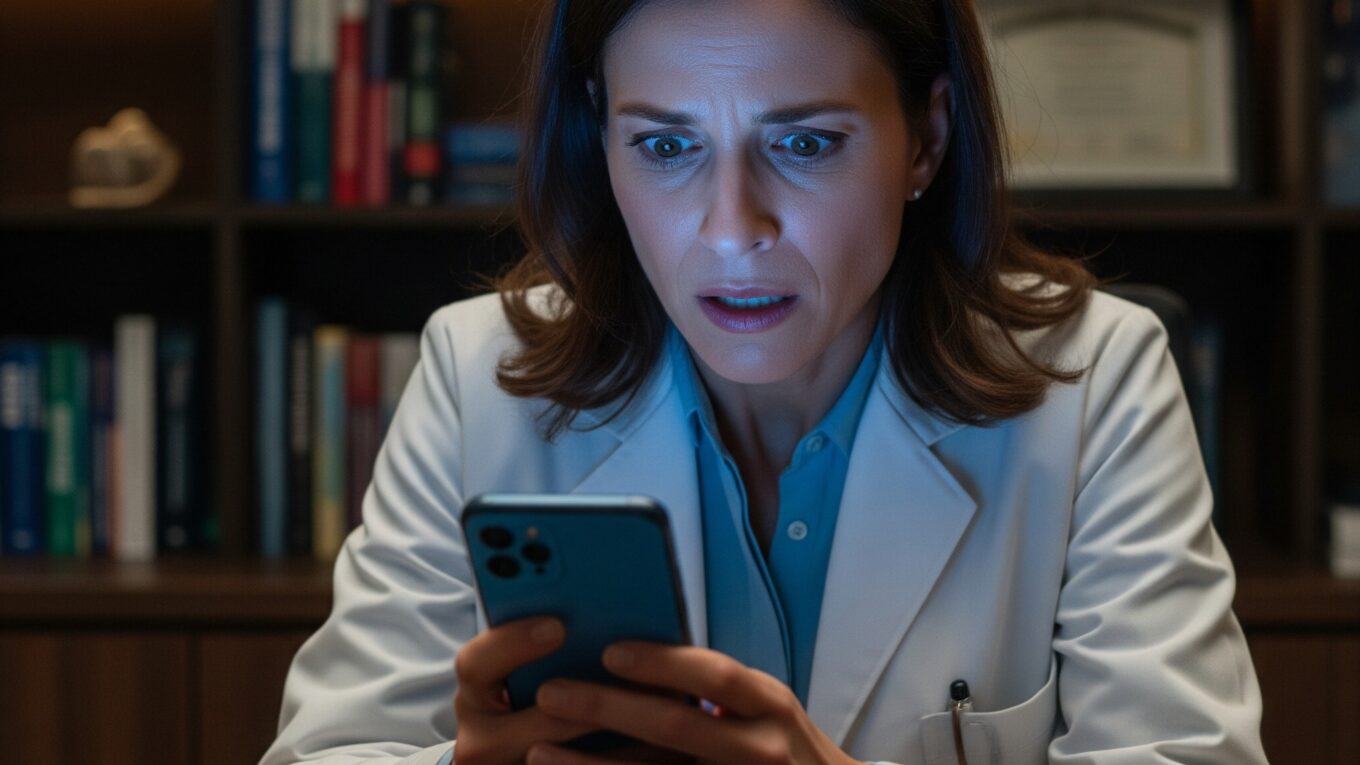

Let me tell you a story about Dr. Sarah.

Sarah isn’t “gullible.” She’s a 45-year-old neurologist with a PhD. She understands the human brain better than 99% of the population. She runs a successful clinic, manages a complex staff, and handles life-or-death decisions daily.

Yet, last Tuesday, Sarah lost $15,000 to a scammer.

It started with a phone call. The caller ID said “Chase Bank Fraud Dept.” The voice on the other end was professional, calm, but urgent. They told her there was a suspicious transfer of $15,000 initiated from her account to a recipient in Miami. Sarah lives in London.

Panic set in.

The agent, “Mark,” told her they could stop it, but they had to act now because the transfer window was closing in three minutes. He sent her a verification code. She read it back. He told her to move her remaining funds to a “secure safety locker account” to protect them while they froze the hackers out.

She did it. And in seconds, her money was gone.

When Sarah sat in my office later, she wasn’t just angry; she was ashamed. “How could I be so stupid?” she asked. “I’m a doctor.”

Here is the truth I tell everyone in my line of work: Sarah didn’t fall for this because she is stupid. She fell for it because she is human.

Fraudsters don’t hack computers nearly as often as they hack people. They are master manipulators who exploit the biological hardwiring of your brain. They know exactly which buttons to push to bypass your logic and access your wallet.

In the industry, we call this Social Engineering. But you can think of it as a biological hijack.

If you think, “I would never fall for that,” you are actually the most vulnerable person in the room. Overconfidence is a blind spot. To truly protect yourself, you need to understand the psychological triggers scammers use to turn your intelligence against you.

Here are the 7 deep-seated psychological levers they pull.

1. Urgency

This is the most common tool in the scammer’s toolkit.

The Psychology: Our brains have two modes of thinking. Psychologists call them System 1 (Fast, emotional, automatic) and System 2 (Slow, logical, calculating). System 2 is what you use to do math or park a car. System 1 is what you use when a lion jumps out of a bush.

When we feel fear or urgency, our brain floods with cortisol. We enter a “Hot State.” The Amygdala (the fear center) hijacks the brain and literally shuts down the Prefrontal Cortex (the logic center).

The Scam Tactic: Scammers must keep you in System 1. If you have time to think, their cover blows. That is why the IRS scammer says the police are on their way right now. It’s why the “tech support” pop-up on your computer has a countdown timer.

Real-World Example: The “Grandparent Scam.” A scammer calls an elderly person, whispering, pretending to be their grandchild. “Grandma, I’m in trouble. I was in a car accident in Mexico. I’m in jail. Please don’t tell Mom and Dad, they’ll kill me. I need bail money wired within the hour or I’ll be moved to general population.”

The urgency (one hour) and the high stakes (safety of a loved one) make it physically impossible for the victim to stop and think, “Wait, why does my grandson sound different?”

2. Authority

We are socialized from birth to obey authority figures. Parents, teachers, police officers, doctors, judges.

The Psychology: In the famous Milgram experiments of the 1960s, psychologists proved that ordinary people would perform acts that went against their conscience (like delivering electric shocks to a stranger) simply because a man in a white lab coat told them to. We have a reflex to comply with titles and uniforms.

The Scam Tactic: Fraudsters drape themselves in the cloak of authority. They don’t just say “Send me money.” They say, “This is Officer Miller from the LAPD,” or “This is the Fraud Department,” or “I am the CEO.”

Real-World Example: The IRS/Tax Agency Impersonation. You get a voicemail saying you owe back taxes and a lawsuit is being filed against you. The caller sounds stern and official. They use legal jargon. They give you a “Badge Number.” Your brain hears “Authority,” and your instinct to comply kicks in before your instinct to question.

3. Scarcity

If you have ever bought something just because the website said “Only 2 items left in stock,” you have felt the pull of scarcity.

The Psychology: Humans are terrified of loss. In fact, psychologically, the pain of losing $100 is twice as intense as the joy of finding $100. We value things more when they are rare or disappearing. This is the Fear of Missing Out (FOMO).

The Scam Tactic: Scammers use this to rush you into investment fraud. They create artificial deadlines or limited supply to bypass your due diligence.

Real-World Example: Crypto Investment Scams. You get added to a WhatsApp group or see an ad: “Exclusive Pre-Sale for the new AI-Coin. Only 50 spots available for early investors. Returns guaranteed at 400%.”

The scarcity (“only 50 spots”) makes you feel like you are stumbling upon a secret goldmine. You rush to transfer your Ethereum not because you trust them, but because you are terrified someone else will get your spot.

4. Reciprocity

This is a subtle but deadly trigger.

The Psychology: If I buy you a coffee, you feel a distinct, nagging pressure to buy me one back. It is a social debt. Human societies are built on Reciprocity. We hate feeling indebted to others.

The Scam Tactic: Scammers will often give you something first. It seems counterintuitive—why would a thief give you money? They do it to lower your defenses and make you feel obligated to “trust” them back.

Real-World Example: The Pig Butchering Scam (Sha Zhu Pan). This is a long-con investment fraud. The scammer meets you online. They get you to invest a small amount, say $500, in a fake trading platform. Then, they let you win. They actually let you withdraw $600. You made a $100 profit! The scammer has “given” you money. Now, when they suggest you invest $50,000 for the “big VIP cycle,” you do it. You trust them because they gave to you first. Once the big money is in, they vanish.

5. Likability and Trust

We assume that attractive, friendly, and relatable people are also honest.

The Psychology: This is known as the Halo Effect. If someone looks good or shares our hobbies, our brain fills in the gaps with other positive traits (honesty, intelligence, kindness). We drop our guard around people we like.

The Scam Tactic: Scammers don’t look like monsters. They look like models, or kind grandmothers, or charming soldiers. They mirror your language. If you mention you like gardening, suddenly they love gardening too.

Real-World Example: Romance Scams. A scammer creates a profile using photos of a handsome engineer working on an oil rig. He spends three months talking to you. He doesn’t ask for money. He asks about your day. He remembers your dog’s name. He sends you poetry. He builds a reservoir of Likability. When the “emergency” happens (a broken machine part, a frozen bank account), you aren’t sending money to a stranger. You are helping a friend.

6. Commitment and Consistency

This is the “Foot-in-the-Door” technique.

The Psychology: Humans have a deep desire to be consistent with their past actions. If I can get you to say “Yes” to a small request, you are statistically much more likely to say “Yes” to a big request later, just to stay consistent with your new identity as “someone who helps.”

The Scam Tactic: Scammers rarely ask for your life savings in the first message. They start small. They engage you in a harmless conversation.

Real-World Example: The “Hi, is this John?” Text. You get a text: “Hi John, are we still meeting for golf?” You reply: “No, sorry, wrong number.” Scammer: “Oh, I’m so sorry! You are very kind to reply. My assistant must have saved the number wrong. I’m Anna, by the way.” By replying to that first text, you made a micro-commitment. You engaged. Now, it feels rude to stop replying. The conversation flows, eventually leading to a pitch about her “fashion business” or “crypto investments.”

7. Social Proof

When we are unsure what to do, we look at what others are doing.

The Psychology: This is the herd mentality. If everyone is looking up at the sky, you will look up too. If a restaurant is empty, you avoid it. If it has a line out the door, you assume the food is great.

The Scam Tactic: Fraudsters fabricate a herd. They know that if you see others “succeeding,” you will suppress your own doubts.

Real-World Example: Fake Reviews and Testimonials. You land on a website selling a gadget or a course. You see 5,000 five-star reviews. You see photos of “Real Customers” holding checks for huge amounts of money. You see a live ticker saying “Susan from Ohio just bought this.” Most of this is hard-coded fake data. But your brain sees the crowd and thinks, “It must be safe if all these people are doing it.”

The Solution

Knowing these triggers is the first step. But in the heat of the moment, when your cortisol is spiking, knowledge can fly out the window.

You need a protocol. Here are three steps to break the spell.

1. The 5-Minute Pause Rule

If anyone, your bank, the police, a lover, or Amazon demands you act immediately, that is a red flag the size of a billboard. Tell them, “I need to grab my charger,” and hang up. Or just put the phone down. Sit in silence for 5 minutes. This allows the cortisol to flush out of your system. It lets your Prefrontal Cortex (logic) come back online. You will be amazed at how different the situation looks after 5 minutes of silence.

2. The “Out of Band” Verification

Never trust the voice on the phone or the email in your inbox. If your “Bank” calls you, hang up. Look at the back of your debit card, find the official number, and call them yourself. This is called “Out of Band” authentication. You are initiating the contact through a trusted channel. If the threat was real, the real bank agent will know about it.

3. The “Buddy Check”

Scammers try to isolate you. They tell you “Don’t tell anyone” or “This is a secret investigation.” Have a designated “Skeptic Buddy.” It could be your spouse, a tech-savvy friend, or your son. Simply saying the story out loud to a third party usually breaks the illusion. Hearing yourself say, “So, Elon Musk is giving away Bitcoin, but I have to send him some first…” makes the scam obvious.

Conclusion

Let’s go back to Dr. Sarah.

She eventually got some of her money back, but the emotional toll lingered. She felt she had lost her “smart card.”

If you take one thing away from this article, let it be this: Falling for a scam is not a sign of stupidity. It is a sign that your brain is working exactly how it evolved to work. We evolved to trust our tribe, to fear danger, and to respect authority.

Scammers are weaponizing your humanity.

The only way to defend yourself is to slow down. Be rude if you have to. Hang up. Verify. And remember, in the digital world, your skepticism is your best friend.

Stay safe out there.

Frequently Asked Questions (FAQ)

What is the number one psychological trigger used in scams?

Urgency is the most common trigger. By creating a false sense of immediate danger (like a blocked bank account) or limited time, scammers force victims into a “Hot State” where logical thinking is bypassed by fear.

Why do intelligent people fall for social engineering?

Intelligence does not override biology. Scammers target emotional responses (fear, greed, empathy) that process faster than logical reasoning. High intelligence can sometimes make people more vulnerable, as they may be overconfident in their ability to detect fraud.

What is the “Foot-in-the-Door” technique in fraud?

This is a psychological tactic based on commitment and consistency. A scammer asks for a small, harmless favor or interaction first (like replying to a text). Once the victim complies, they are psychologically conditioned to agree to larger, more dangerous requests later.